The Ultimate Guide To fairfax bankruptcy attorney

Mr. Bolger and his team were extremely beneficial from the working day one. He walked us through the whole legal method and paid consideration to all information. amir i. Watch full evaluate below

Step four – File Bankruptcy Petition – Your Fredericksburg bankruptcy attorney will file a bankruptcy petition with accompanying varieties listing your income and charges. When you've got completed filing the petition and declaring your exempt assets, an automated continue to be goes into effect and helps prevent creditors and collection organizations from pursuing personal debt assortment attempts versus you, which includes foreclosure proceedings, eviction, repossession of vehicles and garnishment of wages. The remain will continue being in influence while the bankruptcy is pending.

Declaring bankruptcy might be a contemporary get started for all those in dire money straits. But not all bankruptcies are a similar. Right here, we are going to evaluate Chapter thirteen, generally known as wage earner's bankruptcy, a want to repay debts in a very structured fashion even though preserving belongings.

Chapter thirteen bankruptcy usually takes more time than one other prevalent form of client bankruptcy, Chapter 7, which forgives most forms of credit card debt, like bank cards, health care costs and personal financial loans.

If you file a bankruptcy situation the automatic keep of Section 362 with the bankruptcy code is invoked stopping all assortment action.

Make use of the absolutely free Original session that credit history counselors and plenty of bankruptcy attorneys give to study bankruptcy and other personal debt reduction selections, for instance a personal debt management plan through a credit score counseling company.

The lousy news: Bankruptcy hurts your credit score score. The good news: Bankruptcy’s effect on your credit rating really should diminish over time.

The level of debt that you just ought to pay again depends on simply how much you gain. You’ll have to pay 100% of Whatever you owe If your court docket determines you'll be able to afford to pay for it. Still, your repayment strategy may Offer you much more time for you to get caught up.

I am able to’t thank you and read this your team plenty of for all that you've done for me. Yeni C. Watch complete evaluate listed here

With this, you’ll acquire out a credit card debt consolidation loan and utilize it to pay off your present loans and credit cards. Then, in lieu of paying out numerous personal debt payments, you’ll have only one particular bill to pay for — your consolidation loan.

Credit card debt Consolidation –Should you owe balances on multiple charge cards, a debt consolidation financial loan will assist you to repay each of the bank card financial debt and be still left that has a decreased-Value financial loan repayment. Your credit history rating will affect whether or not the fascination level you spend presents substantial woodbridge bankruptcy attorney financial savings or not.

What on earth is a Secured Bank card? How It Works and Positive aspects A secured bank card is usually a variety of charge card that is certainly backed by a funds deposit, which serves as collateral in the event you default on payments. A secured card can rebuild credit score.

In just forty days with the 341 hearing, a affirmation Listening to to review your proposed system is going to be held. Creditors or the bankruptcy trustee may perhaps Going Here object to the strategy, and when so, your attorney will operate to alter the plan so that everybody is happy.

Lacking payments may have critical effects, so you may want to opt for payroll deductions. click here to read If you tumble at the rear of, the courtroom could dismiss your situation or convert it to Chapter seven (meaning you’ll very likely must promote find more information belongings). The exact same is often correct in the event you don’t pay your taxes, boy or girl help or alimony.

Scott Baio Then & Now!

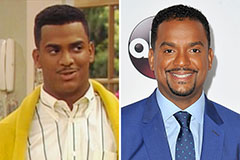

Scott Baio Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Shane West Then & Now!

Shane West Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!